What States Are Property Tax Free . And learn some additional details about taxes owed,. The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. these taxes are local governments’ primary tool for funding a variety of services associated with. The median property tax bill. key findings of our research: If you want to see which states have the lowest property taxes, here’s a breakdown of the. States with the lowest property taxes levied by their municipalities. there are 21 states with property tax rates above the national average. discover the u.s. in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. currently, new jersey has the highest effective property tax rate in the u.s.

from decaturtax.blogspot.com

And learn some additional details about taxes owed,. If you want to see which states have the lowest property taxes, here’s a breakdown of the. discover the u.s. The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. currently, new jersey has the highest effective property tax rate in the u.s. there are 21 states with property tax rates above the national average. key findings of our research: these taxes are local governments’ primary tool for funding a variety of services associated with. The median property tax bill. in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50.

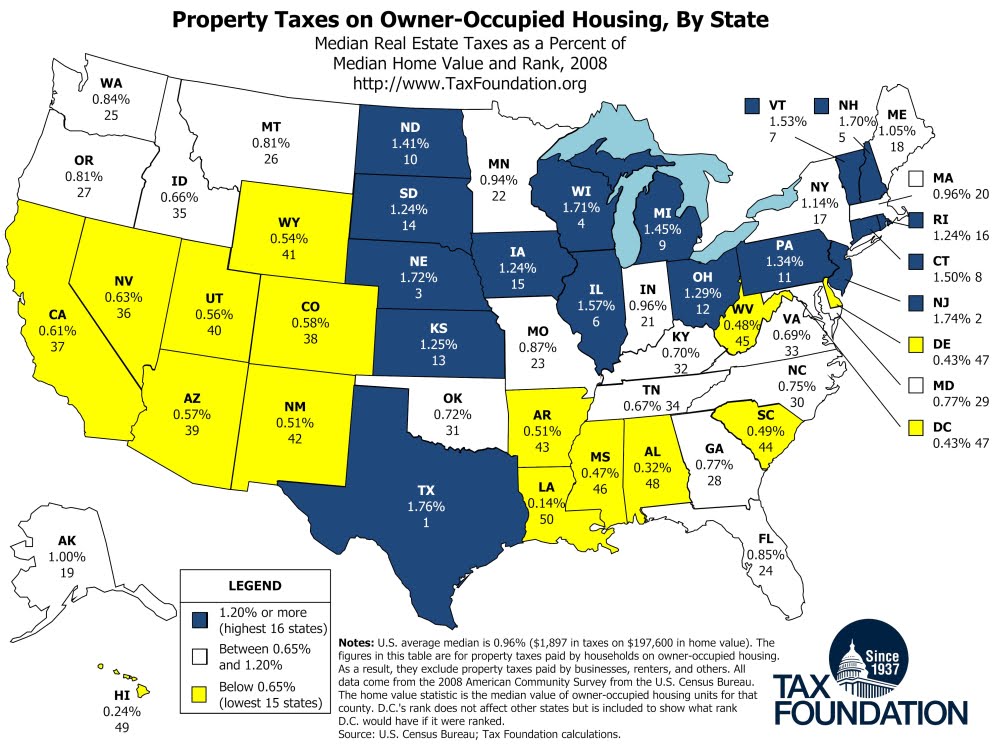

Decatur Tax Blog median property tax rate

What States Are Property Tax Free discover the u.s. States with the lowest property taxes levied by their municipalities. discover the u.s. in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. And learn some additional details about taxes owed,. there are 21 states with property tax rates above the national average. The median property tax bill. these taxes are local governments’ primary tool for funding a variety of services associated with. If you want to see which states have the lowest property taxes, here’s a breakdown of the. The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. currently, new jersey has the highest effective property tax rate in the u.s. key findings of our research:

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills What States Are Property Tax Free If you want to see which states have the lowest property taxes, here’s a breakdown of the. The median property tax bill. And learn some additional details about taxes owed,. there are 21 states with property tax rates above the national average. discover the u.s. States with the lowest property taxes levied by their municipalities. The average annual. What States Are Property Tax Free.

From www.mortgagecalculator.org

Median United States Property Taxes Statistics by State States With What States Are Property Tax Free currently, new jersey has the highest effective property tax rate in the u.s. The median property tax bill. The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. these taxes are local governments’ primary tool for funding a variety of services associated with. in order to help, we put together a. What States Are Property Tax Free.

From www.pinterest.com

New Online Resource StatebyState Property Tax at a Glance Property What States Are Property Tax Free discover the u.s. States with the lowest property taxes levied by their municipalities. And learn some additional details about taxes owed,. key findings of our research: The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. The median property tax bill. If you want to see which states have the lowest property. What States Are Property Tax Free.

From www.joancox.com

Property Tax Rates What States Are Property Tax Free And learn some additional details about taxes owed,. The median property tax bill. these taxes are local governments’ primary tool for funding a variety of services associated with. States with the lowest property taxes levied by their municipalities. there are 21 states with property tax rates above the national average. discover the u.s. key findings of. What States Are Property Tax Free.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment What States Are Property Tax Free The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. If you want to see which states have the lowest property taxes, here’s a breakdown of the. discover the u.s. currently, new jersey has the highest effective property tax rate in the u.s. The median property tax bill. in order to. What States Are Property Tax Free.

From michaelryanmoney.com

A Guide To 9 States With No Tax Navigating The Tax What States Are Property Tax Free these taxes are local governments’ primary tool for funding a variety of services associated with. The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. currently, new jersey has the highest effective property tax rate in the u.s. States with the lowest property taxes levied by their municipalities. discover the u.s.. What States Are Property Tax Free.

From www.dontmesswithtaxes.com

17 states & D.C. collect an estate or inheritance tax Don't Mess With What States Are Property Tax Free in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. And learn some additional details about taxes owed,. key findings of our research: discover the u.s. States with the lowest property taxes levied by their municipalities. there are 21 states with property tax. What States Are Property Tax Free.

From americanexperimentnd.org

10,000+ apply on first day of new state property tax credit What States Are Property Tax Free The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. discover the u.s. And learn some additional details about taxes owed,. these taxes are local governments’ primary tool for funding a variety of services associated with. States with the lowest property taxes levied by their municipalities. If you want to see which. What States Are Property Tax Free.

From www.cbpp.org

State “Mansion Taxes” on Very Expensive Homes Center on Budget and What States Are Property Tax Free in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid, in all 50. key findings of our research: there are 21 states with property tax rates above the national average. these taxes are local governments’ primary tool for funding a variety of services associated with. . What States Are Property Tax Free.

From www.slideteam.net

States Property Tax Tax In Powerpoint And Google Slides Cpb What States Are Property Tax Free these taxes are local governments’ primary tool for funding a variety of services associated with. there are 21 states with property tax rates above the national average. currently, new jersey has the highest effective property tax rate in the u.s. discover the u.s. And learn some additional details about taxes owed,. If you want to see. What States Are Property Tax Free.

From rethority.com

Property Tax by County & Property Tax Calculator REthority What States Are Property Tax Free key findings of our research: discover the u.s. there are 21 states with property tax rates above the national average. these taxes are local governments’ primary tool for funding a variety of services associated with. in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid,. What States Are Property Tax Free.

From www.biggerpockets.com

States With The Lowest Property Taxes In 2023 What States Are Property Tax Free The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. The median property tax bill. If you want to see which states have the lowest property taxes, here’s a breakdown of the. discover the u.s. these taxes are local governments’ primary tool for funding a variety of services associated with. key. What States Are Property Tax Free.

From wallethub.com

Property Taxes by State What States Are Property Tax Free these taxes are local governments’ primary tool for funding a variety of services associated with. key findings of our research: The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. And learn some additional details about taxes owed,. discover the u.s. If you want to see which states have the lowest. What States Are Property Tax Free.

From dailysignal.com

How High Are Property Taxes in Your State? What States Are Property Tax Free The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. If you want to see which states have the lowest property taxes, here’s a breakdown of the. discover the u.s. And learn some additional details about taxes owed,. key findings of our research: currently, new jersey has the highest effective property. What States Are Property Tax Free.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics What States Are Property Tax Free The median property tax bill. States with the lowest property taxes levied by their municipalities. discover the u.s. And learn some additional details about taxes owed,. there are 21 states with property tax rates above the national average. these taxes are local governments’ primary tool for funding a variety of services associated with. key findings of. What States Are Property Tax Free.

From taxfoundation.org

State & Local Property Tax Collections per Capita Tax Foundation What States Are Property Tax Free If you want to see which states have the lowest property taxes, here’s a breakdown of the. key findings of our research: The average annual property tax rate for all 50 states is 1.10% or $3,909.66 per year. in order to help, we put together a full breakdown of the property tax rates, and property tax amount paid,. What States Are Property Tax Free.

From www.nahb.org

State Property Taxes Continue to Highlight Differences Across the What States Are Property Tax Free discover the u.s. The median property tax bill. these taxes are local governments’ primary tool for funding a variety of services associated with. currently, new jersey has the highest effective property tax rate in the u.s. there are 21 states with property tax rates above the national average. States with the lowest property taxes levied by. What States Are Property Tax Free.

From www.cbpp.org

State Estate Taxes A Key Tool for Broad Prosperity Center on Budget What States Are Property Tax Free The median property tax bill. key findings of our research: currently, new jersey has the highest effective property tax rate in the u.s. there are 21 states with property tax rates above the national average. States with the lowest property taxes levied by their municipalities. The average annual property tax rate for all 50 states is 1.10%. What States Are Property Tax Free.